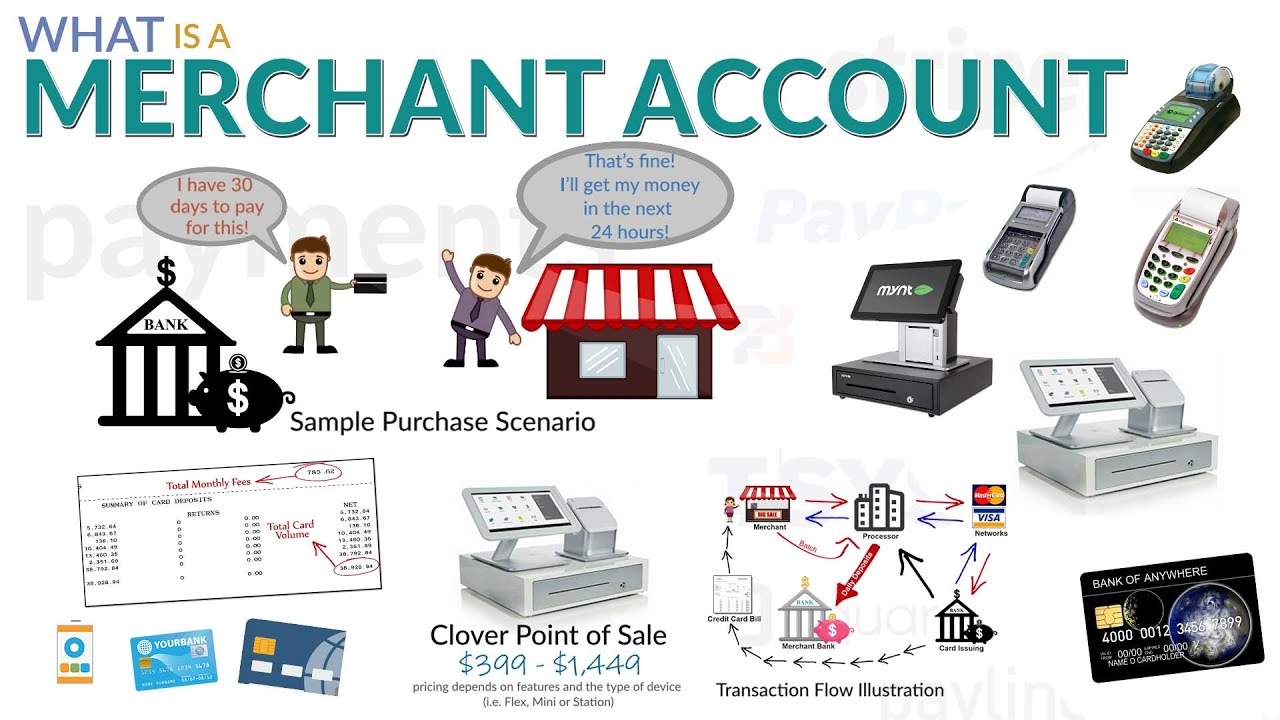

Merchants have a variety of options to manage their credit card sales and take advantage of other payment processing services. A merchant account is developed under an agreement between a merchant accepting credit card deals and an obtaining bank. Accepting payments via debit card needs an extensive quantity of equipment and software. For businesses who are new in the small business of accepting payments by means of debit card, setting up a merchant account can be a challenge.

Debit card payments are processed rapidly due to the fact that they are really hassle-free. They are fast ending up being a norm in numerous business industries. Almost all major business are now adopting credit card processing for online transactions due to the fact that it is really hassle-free and fast. For that reason, accepting credit card payments is one of the most affordable ways of producing revenue. This means that when a company begins accepting credit card payments, it takes a huge bite out of its budget plan.

Nevertheless, before opening a merchant account, there are a variety of things to consider initially. These consist of finding a suitable debit card processor that will give your small business the best rate of payables per month. Your processor must not just process your debit card transactions but also supply payment entrance services, such as permission and file encryption, as well as transaction processing, cleaning, and conversion for e-commerce transactions. A merchant account provider that can supply these extra services is an excellent option.

A merchant account supplier must, for that reason, be reputable in business. It should have a strong customer base and have actually been functional for a minimum of 6 months. The minimum period of operation for opening a merchant account is 3 years. In order to get approved for merchant accounts, a business needs to likewise be in operation for at least 2 years. While banks and other financial institutions generally require longer durations https://www.easypaydirect.com/ of operation, they typically do not require as much history. A business that has been processing debit card deals continually for at least a year is normally an outstanding prospect.

Your processor might just have the ability to process debit card payments, which are cashless purchases made with a debit card or a prepaid visa or master card. Some merchant account service providers vary in their ability to procedure debit card payments. Prior to selecting a company, it is very important to determine how your business prepares to increase its existing volume of transactions over the next couple of months and years. If you plan to broaden your company over the next few years, select a merchant account supplier that can process both credit and debit card deals. Otherwise, you will have to upgrade your existing account, which is not always a cost-efficient choice.

Your transaction costs depend upon the type of services you are using. A supplier that processes electronic kinds of payments such as credit and debit card payments needs to charge a charge for its services. Different companies charge various rates for this service.

If your business will be accepting debit card payments, pick a company that charges a lower fee for this service. A company that charges more than 50% for debit card transactions is unneeded. You will also need to ask about what types of scams protection are consisted of with each account. Protection differs among service providers and is necessary to your buyers. Fraud management includes scams detection, fraud signals, and scams decrease.

Buyer management includes day-to-day contact with clients. The purpose of this service is to help you comprehend the needs of your client and to assist in their fulfillment. Different merchant account service providers let companies to choose in between an integrated buyer management system and a standalone solution. An integrated system integrates the aspects of customer management, merchant services and payment processing for a smooth buyer experience. A standalone solution lets you to choose aspects that are best for your business.

More Info:

Easy Pay Direct

#240-2006, 2028 East Ben White Boulevard

Austin, Texas 78741